Optimal Robust Reinsurance with Multiple Insurers

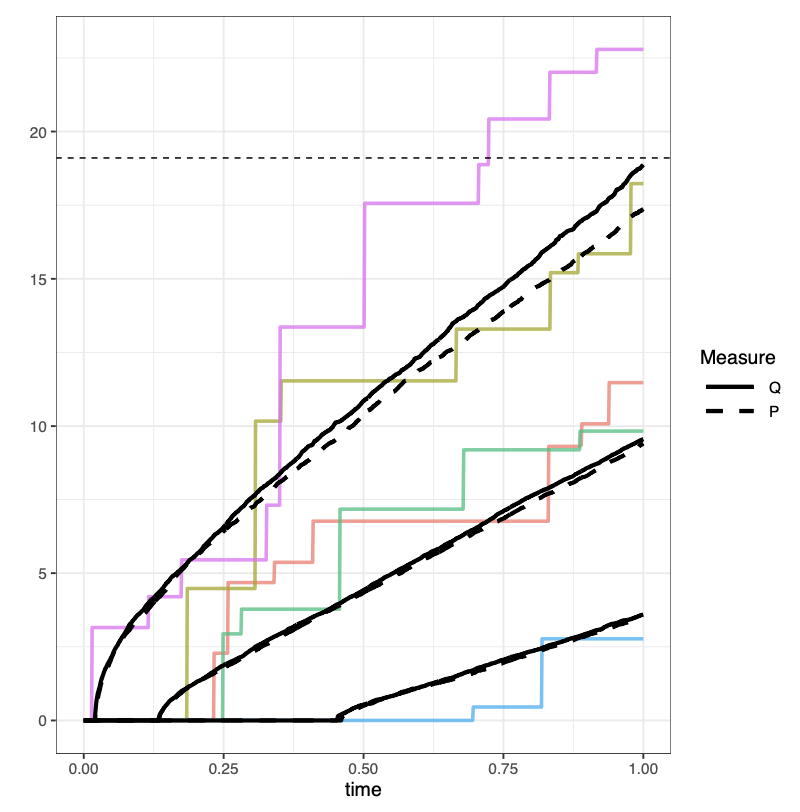

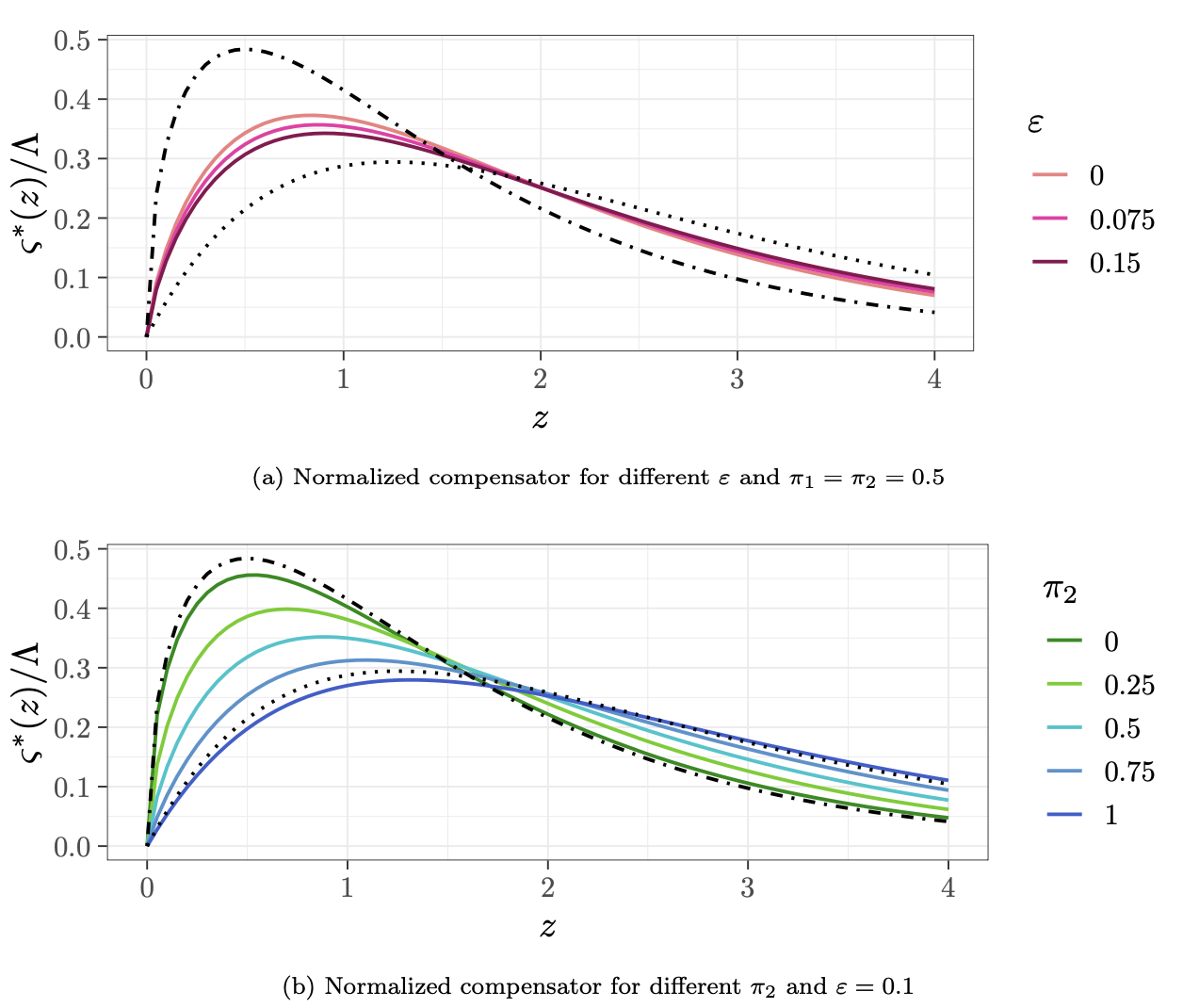

We study a reinsurer who faces multiple sources of model uncertainty. The reinsurer offers contracts to n insurers whose claims follow different compound Poisson processes. As the reinsurer is uncertain about the insurers’ claim severity distributions and frequencies, they design reinsurance contracts that maximise their expected wealth subject to an entropy penalty. Insurers meanwhile seek to maximise their expected utility without ambiguity. We solve this continuous-time Stackelberg game for general reinsurance contracts and find that the reinsurer prices under a distortion of the barycentre of the insurers’ models.