Publications & Preprints

Model Ambiguity in Risk Sharing with Monotone Mean-Variance

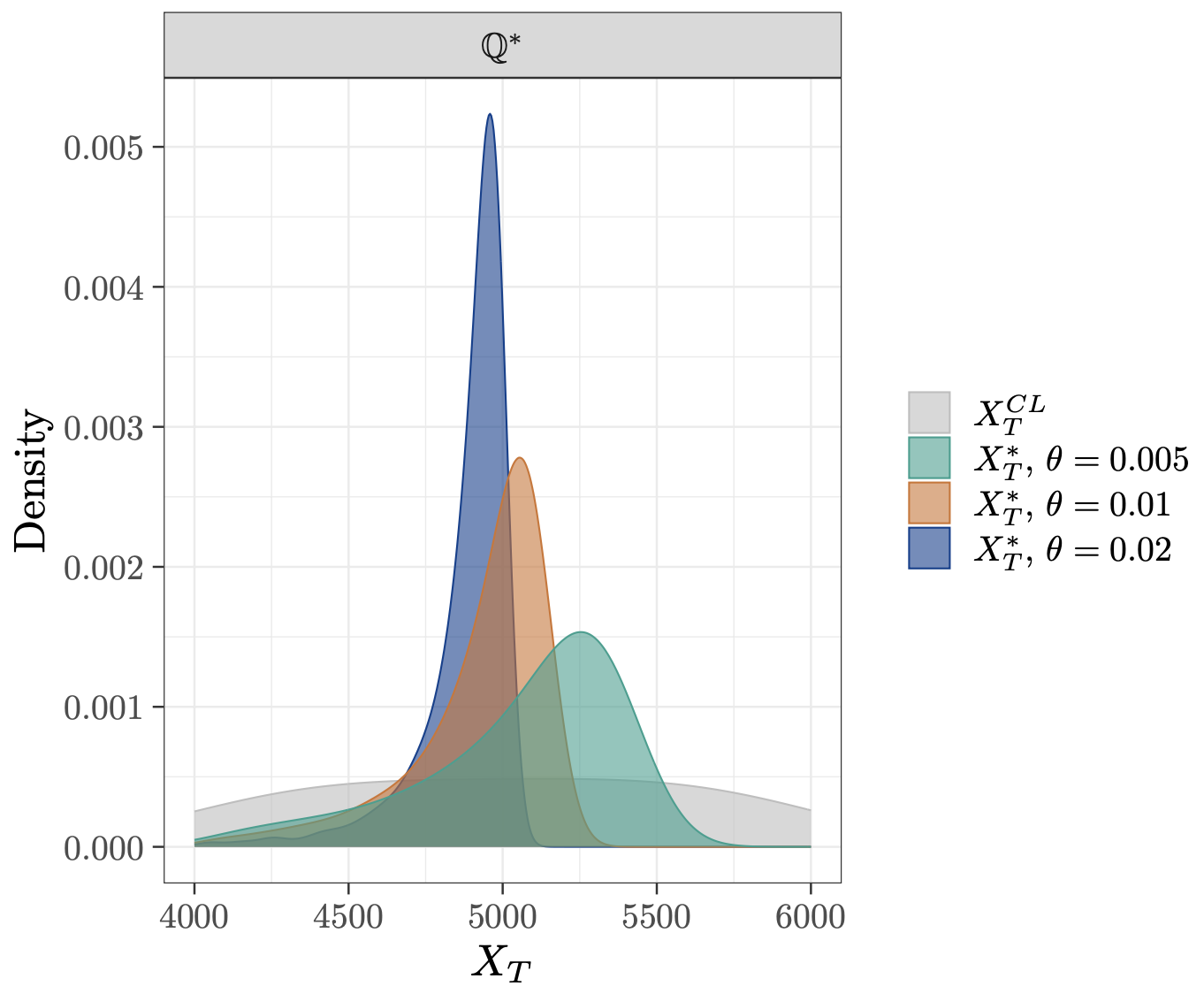

We consider the problem of an agent who faces losses over a finite time horizon and may choose to share some of these losses with a counterparty. The agent is uncertain about the true loss distribution and has multiple models for the losses. Their goal is to optimize a mean-variance type criterion with model ambiguity through risk sharing. Read more

Optimal Robust Reinsurance with Multiple Insurers

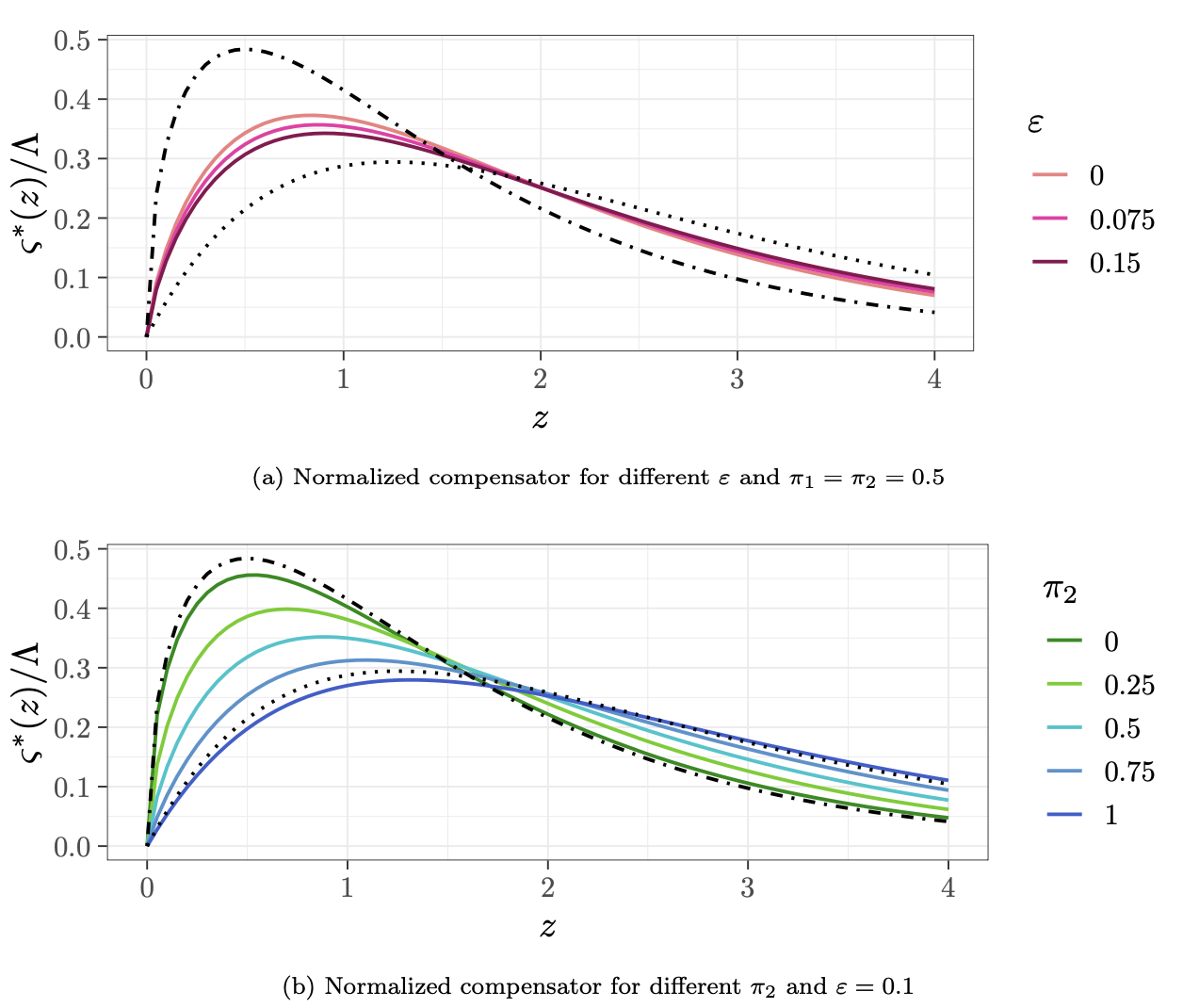

We study a reinsurer who faces multiple sources of model uncertainty. The reinsurer offers contracts to n insurers whose claims follow different compound Poisson processes. As the reinsurer is uncertain about the insurers’ claim severity distributions and frequencies, they design reinsurance contracts that maximise their expected wealth subject to an entropy penalty. Insurers meanwhile seek to maximise their expected utility without ambiguity. We solve this continuous-time Stackelberg game for general reinsurance contracts and find that the reinsurer prices under a distortion of the barycentre of the insurers’ models. Read more